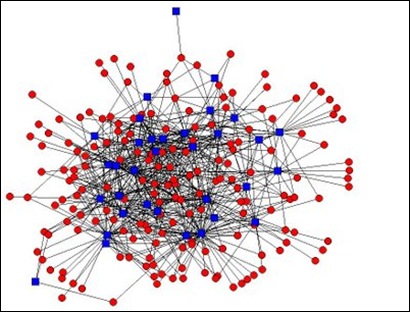

Graphic illustration of “systemic risk” from complexity

Friday, 12 March, 2010 Leave a comment

Notional vs net: complexity is our enemy

The credit default swap(CDS) market, where AIG played, had notional outstanding value of about $45 trillion at the end of 2007 (about $60 trillion at Sept 08). Of course many of these contracts are partially cancelling, so the net value of contracts in the market is much smaller than the notional value.

Unfortunately, the network diagram (network of contracts) probably looks something like this:

Imagine removing — due to insolvency, lack of counterparty confidence, lack of shareholder confidence, etc. — one of the nodes in the middle of the graph with lots of connections. What does that do to the detailed cancellations that reduce the notional value of $45 trillion to something more manageable? Suddenly, perfectly healthy nodes in the system have uncanceled liabilities or unhedged positions to deal with, and the net value of contracts skyrockets. This is why some entities are too connected to fail, as opposed to too BIG to fail. Systemic risk is all about complexity.

Here’s a simple example of a network of contracts whose notional value is much larger than its net value. Suppose A = AIG, B = Barclays and C = Citigroup have traded CDS contracts related to a particular pool mortgages. If defaults in the pool exceed some threshold, A must pay B $1 billion, but will receive $1.1 billion from C. Now suppose there is a third contract in which B pays $1 billion to C if defaults exceed the threshold. The notional value of all contracts is $3.1 billion, but the net value that changes hands is only $.1 billion. So notional value is 31 times net.

B’s position is completely neutral and A and C only have $.1 billion at risk. This may sound contrived, but it’s actually not unrealistic.

Everything is fine until, say, A has a problem. Suppose A becomes insolvent and *poof* disappears. B and C are left with a naked $1 billion bet on mortgages. Suddenly the notional value, which wasn’t previously very representative of the amount at risk, due to the cancelations, isn’t far off from the amount at risk ($3.1 vs 1 billion).

Now scale this little example up to, say, $45 trillion in notional value, thousands of bets and dozens of firms, and you’ve got systemic risk!